- Alfred Rappaport 7 Value Drivers 7,2/10 4941 votes Executive Summary Reprint: R0609C Executives have developed tunnel vision in their pursuit of shareholder value, focusing on short-term performance at the expense of investing in long-term growth.

- Usb Home Endoscope Driver Download Nokia 302 Brown Theme Download 10ec 8136 Driver Win7 Planet 1 Hueber Matteo Tarantino Disco Grafia Beatles Anime Indo.id Gpa Emulator Mac Disable Notification On Outlook For Mac Prime Timetable Crack Alfred Rappaport Shareholder Value Pdf.

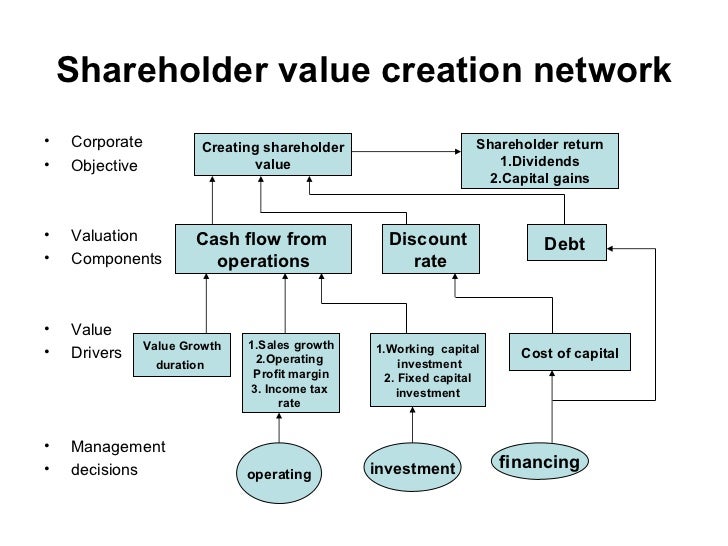

Alfred Rappaport 7 Value Drivers Every for-profit organisation has the objective of generating a consistent, profitable growth and providing its investors with a return. This return should be at least equal to what investors would receive if funds were invested into alternative investments with similar risk features.

High returns do not always create value. Return on high risk investment. High-level Drivers of Shareholder Value. Alfred Rappaport prescribes ten Basic. Nov 06, 2007 Deduce the value drivers of Alfred Rappaport and show how they contribute to company's valuation? What would you name seven children? More questions. Whats your favorite Alfred Hitchcock movie? What would you name SEVEN boys with these names? Answer Questions.

The march has become one of the largest such demonstration in Europe, and on Saturday it drew far-right leaders from elsewhere in Europe, including Tommy Robinson from Britain and Roberto Fiore from Italy. הטמעת הסרטון באתר שלך קוד להטמעה: Police estimated that 60,000 people took part. State broadcaster TVP, which reflects the conservative government’s line, called it a “great march of patriots,” and in its broadcasts described the event as one that drew mostly regular Poles expressing their love of Poland, not extremists; though one participant in the far-right march interviewd by the channel said he was taking part “to remove from power.” The Wall Street Journal reported that some of the protesters chanted 'pure white Europe—no Jews, no Muslims' and 'purify Poland.' Many were young men, some with their faces covered or with beer bottles in hand, but families and older Poles also participated. Ratchet po praktiker uchastkovogo milicii. (Photo: Reuters) “It was a beautiful sight,” Interior Minister Mariusz Blaszczak said.

Executive Summary Reprint: R0609C Executives have developed tunnel vision in their pursuit of shareholder value, focusing on short-term performance at the expense of investing in long-term growth. It’s time to broaden that perspective and begin shaping business strategies in light of the competitive landscape, not the shareholder list. In this article, Alfred Rappaport offers ten basic principles to help executives create lasting shareholder value. For starters, companies should not manage earnings or provide earnings guidance; those that fail to embrace this first principle of shareholder value will almost certainly be unable to follow the rest.

Additionally, leaders should make strategic decisions and acquisitions and carry assets that maximize expected value, even if near-term earnings are negatively affected as a result. During times when there are no credible value-creating opportunities to invest in the business, companies should avoid using excess cash to make investments that look good on the surface but might end up destroying value, such as ill-advised, overpriced acquisitions. It would be better to return the cash to shareholders in the form of dividends and buybacks. Rappaport also offers guidelines for establishing effective pay incentives at every level of management; emphasizes that senior executives need to lay their wealth on the line just as shareholders do; and urges companies to embrace full disclosure, an antidote to short-term earnings obsession that serves to lessen investor uncertainty, which could reduce the cost of capital and increase the share price. The author notes that a few types of companies—high-tech start-ups, for example, and severely capital-constrained organizations—cannot afford to ignore market pressures for short-term performance. Most companies with a sound, well-executed business model, however, could better realize their potential for creating shareholder value by adopting the ten principles.

Alfred Rappaport 7 Value Drivers Theory

Many firms sacrifice sustained growth for short-term financial gain. For example, a whopping 80% of executives would intentionally limit critical R&D spending just to meet quarterly earnings benchmarks.

They miss opportunities to create enduring value for their companies and their shareholders. How to cultivate the future growth your firm needs to succeed? Rappaport identifies 10 powerful practices. First among them: Don’t get sucked into the short-term earnings-expectation game—it only tempts you to forgo value-creating investments to report rosy earnings now. Another practice: Ensure that executives bear the same risks of ownership that shareholders do—by requiring them to own stock in the firm. At eBay, for example, executives have to own company shares equivalent to three times their annual base salary. EBay’s rationale?

Implementing Shareholder Value Analysis • • • Updated on: November 16, 2007 / 5:26 PM / MoneyWatch Shareholder value analysis (SVA) is one of several nontraditional metrics being used in business today. SVA determines the financial value of a company by looking at the returns it gives its stockholders and is based on the view that the objective of company directors is to maximize the wealth of company stockholders. What You Need to Know How is shareholder value calculated? Shareholder value is calculated by dividing the estimated total net value of a company based on its present and future cash flows by the value of its shares of stock. The resulting figure indicates the company's value to stockholders.

Why adopt SVA? The underlying principle of shareholder value is that a company adds value for its stockholders only when equity returns exceed equity costs.

Once the amount of value has been calculated, targets for improvement can be set and shareholder value can be used as a measure for managing performance. What are the advantages of using SVA? Borland bde windows 10. Shareholder value analysis: • takes a long-term financial view on which to base strategic decisions; • offers a universal approach that is not subject to differences in companies' accounting policies and is therefore applicable internationally and across business sectors; • forces the organization to focus on the future and its customers, particularly the value of future cash flows.

What to Do Obtain the Commitment of Top Management Underlying SVA is the belief that the creation and maximization of shareholder value is the most important measure of business performance. Top managers need to commit to this objective in order for the SVA approach to proceed and take root. They should also agree that traditional measures and approaches may not succeed in achieving this objective. Understand and Calculate the Company's Shareholder Value Before adopting shareholder value as a significant financial objective, you need to understand its implications and the best way for your business to approach it. It can be helpful to first plan the approach with professional advisers such as accountants or consultants who specialize in this area. A company's value is calculated by subtracting the market value of any debts owed to the company from the total value of the business. The total value of a business has three main components: • the present value of future cash flows during the planned period; • the residual value of future cash flows from a period beyond the planned period; • the weighted average cost of capital.

Shareholder Value by Alfred Rappaport. Performance on key value drivers they influence directly. Like to affect” (Principles 7 and 8). So far, Berkshire looks. What are the seven value drivers of Alfred Rappaport? There are many cell phone plans that you can view online. Basically, there are a couple of ways prepaid cell phone plans. A cell phone plan is an agreement with a provider to get.

Alfred Rappaport 7 Value Drivers Model

Total business value is calculated by adding present value of future cash flows to residual value of future cash flows and dividing it by the weighted average cost of capital. If the result of this calculation is greater than one, then the company is worth more than the invested capital and added value is being created. • Future cash flows Future cash flows are affected by growth, returns, and risk.